2025 – Q1 Market Update

Dear Clients and Friends,

We know 2025 did not start the way we envisioned. We all know someone personally that was affected by the LA County fires that ravaged the Palisades and Altadena communities in early January. In the coming months and years, we are going to have to work together to find ways to help clients, family, and friends rebuild their homes and their lives. To navigate what’s likely to be a frustrating world of insurance policies, FEMA claims, document recovery, legal expenses, and more. Many will feel lost in a financial wilderness. This is where our collective sense of purpose lives. Please lean on us, it will take a village as they say.

2024 Market Performance

2024 was a remarkable year for the equity market. The S&P 500 gained 25% (the second consecutive year of 20+% gains) and was the third-best annual return for the index since 2000. This impressive performance has been supported by several factors: the economy continuing to surprise to the upside, moderating inflation, and the Federal Reserve (Fed) beginning to ease monetary policy.

Post-Election Market Dynamics

The S&P 500 has gained 5.5% since the election as markets applauded President-elect Trump’s pro-growth agenda. However, we recognize that campaign promises do not always materialize during presidential terms. Tariffs, taxes, and deregulation have become the three largest policy-related focuses of the market. Thus far, the perceived positive market impacts from deregulation and taxes have outweighed potential negative impacts to profitability and inflation from tariffs.

Investor Sentiment and Portfolio Performance

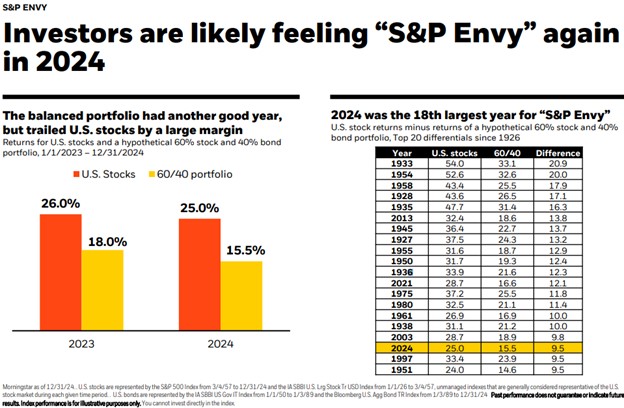

Investors are likely feeling “S&P Envy” again in 2024. A balanced portfolio had another good year, but trailed US stock by a large margin and the chart indicates1:

2024 was the 18th largest year for “S&P Envy” when comparing the S&P return to a hypothetical 60/40 portfolio.

The Importance of Diversification

A common question we hear from investors is, “Why don’t we just invest everything in the S&P 500?” It’s an understandable thought, especially after a period of strong market performance. However, focusing solely on one index—or any single investment—can significantly increase your risk.

The S&P 500 has delivered impressive returns in recent years, but past performance doesn’t guarantee future success. Today, the index is priced at historically high levels and is heavily concentrated, with a handful of companies making up a large portion of its total value. This concentration can create vulnerability, especially if those leading companies underperform.

As investors, it’s critical to balance risk and reward by diversifying across different asset classes, sectors, and geographies. A well-constructed, diversified portfolio allows you to participate in market growth while reducing the potential impact of a downturn in any single area.

In essence, diversification helps you avoid the temptation to chase what worked yesterday and instead focus on what’s most likely to help you reach your long-term goals.

Managing Risk and Emotions in Investing

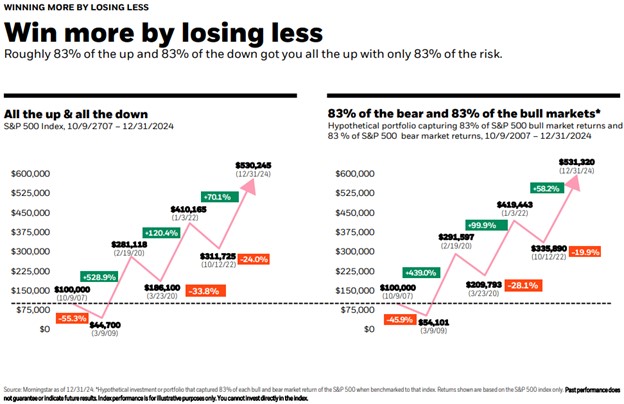

As fiduciaries, our job is to manage risk vs. reward. We want our clients to succeed with the least amount of risk possible but understand risk is necessary to take in order to achieve long-term financial success. When you look at the chart, this shows the S&P 500 performance since 10/9/2007 compared to a portfolio with 83% of the bear and 83% of the bull market returns. They virtually get to the same place by 12/31/2024, but the ride with less risk should be an “easier” ride on the investor. While we say, investors should never act based off emotion, we are not naïve that investing is emotional²:

Strategic Considerations for 2025

For current clients, we are employing the following considerations but wanted to summarize the key points for what others should be looking for in 2025:

- Rebalance portfolio back to target allocations

- There were several trades made in 2024 that are requiring us to rebalance the accounts; taking gains off the table and reallocating to underweight positions or more conservative assets.

- We are encouraging investors who take an annual RMD from their IRA account to consider taking early in the year. This way, they are selling at (almost) all-time market highs and locking in good pricing to take risk off the table and meet annual RMD spending requirement.

- Maintain balance between growth/value, Large companies/Small & mid companies, US vs. International.

- Expect volatility

- Market Valuations are stretched for someRecessionary risks – In our minds, more sector to sector focused vs. across the board

- Geopolitical risk – New administration growing pains

- Fixed Income Investments

- Reduce Money Market, T-Bill & Short-Term Bonds

- Increase Duration…Begin the shift to longer term bonds

- Focus on High Quality

If you would like to discuss your long-term financial plan in greater detail or would value a review of your current investments, please get in touch with our office to schedule time with one of our Wealth Advisors. If you are not currently a client and value a second opinion, we are here to help. Now is a better time than ever to look at your current investments and financial plan to make sure they are properly positioned for the unexpected.

Regards,

Jerrod Ferguson, CFP®

Vice President

Disclosures: The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Past performance does not guarantee future results. The information provided is for educational and illustrative purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Vance Wealth, Inc. (“Vance Wealth”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Vance Wealth and its representatives are properly licensed or exempt from licensure. The S&P 500 is an unmanaged index of 500 widely held stocks. Investors cannot invest directly in an index.

Sources:

- BlackRock – Student of the Market, January 2025. “Investors are likely feeling “S&P Envy” again”

- BlackRock – Student of the Market, January 2025. ”Win more by losing less”