Posts by Jerrod Ferguson

Long-Term Investing: Finding Optimism in Today’s World

In a world where negative news dominates headlines, even seasoned investors may find it challenging to stay committed to their long-term financial plans. However, amidst the noise, there are reasons to remain optimistic about the future of investing. Here are five key points to consider: Strength of the U.S. Economy Despite fears of a recession,…

Read MoreCreating a Legacy: Achieve More through Purposeful Planning

Legacy planning is about more than passing on wealth to the next generation. At Vance Wealth, it’s also about passing on the stories, lessons and values that allowed you to accumulate your wealth in the first place. “That’s how you build a legacy to last,” explained John Vance, President of Vance Wealth. “In fact, many…

Read More2024 Q1 Market Update

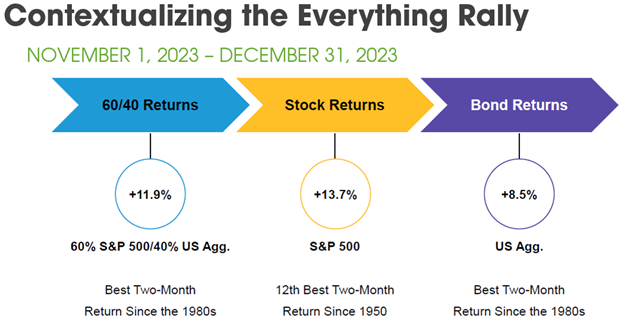

We hope you enjoyed the holiday season with the ones that matter most. Everyone at Vance Wealth is excited for this New Year, and we are motivated to begin making progress on our personal and firm goals. While past performance is not indicative of future results, we like to reflect on the past year to…

Read MoreSetting Goals That Stick In Life & Business

As a business owner, your success is only as strong as the foundation it’s built on: you. If you’re not operating at your best, you can’t give your best to your business. That’s why it’s important to start your business planning with a big-picture view of your life and personal finances. By aligning your business…

Read MoreMaximize Your Charitable Impact With This Quick Tip

Impactful Wealth: Strategies for Giving Back and Financial Growth Your financial plan is a powerful tool that can extend its impact far beyond your personal goals. When infused with intention and heart, it becomes a path to something greater. Many of our clients recognize the importance of including charitable giving in their financial success plan.…

Read More7 Social Security Myths & Truths

There’s so much at stake when it comes to determining your ideal retirement plan. How do you ensure you’re getting the most from your hard-earned Social Security benefits? Deciding when to file can be confusing enough as you attempt to juggle the many variables that determine your optimal plan. Yet plenty of misinformation persists around this topic,…

Read MoreBuild a Lasting Legacy – 5 Steps To Planning Your Legacy With Purpose & Intention

Build a Lasting Legacy 5 Steps To Planning Your Legacy With Purpose & Intention Every day, we spend our time and energy trying to get from where we are to where we want to be. Each morning routine, every check off that to-do list – it all adds up to the legacy we hope to one day leave…

Read MoreRetirement Tips by Generation: Maximize Your Savings During Each Stage of Life

It’s never too early to start planning for retirement – and it’s never too late. In fact, the best time to begin preparing for your ideal financial future is now. However, the right retirement and savings strategies are different at each stage of life. To help you get an idea of where to start, here…

Read More