Uncategorized

2025 – Q1 Market Update

Dear Clients and Friends, We know 2025 did not start the way we envisioned. We all know someone personally that was affected by the LA County fires that ravaged the Palisades and Altadena communities in early January. In the coming months and years, we are going to have to work together to find ways to…

Read MoreBEST PRACTICES FOR THE SEAMLESS TRANSFER OF WEALTH

Leaving Behind a Meaningful Financial Legacy Leaving behind a meaningful financial legacy is about more than just wealth. At Vance Wealth, we believe it’s also about protecting your family’s peace of mind. It’s difficult enough to pick up the torch and carry on the family legacy without the undue burden of a messy and confusing…

Read MoreVANCE WEALTH TEAM MEMBER SPOTLIGHT

With a passion for digital marketing and a versatile skill set, Operations Associate Roy Carter brings creativity and efficiency to his role at Vance Wealth. Originally from North Hollywood, Roy moved to Santa Clarita at age 8 and has called it home ever since. His entrepreneurial spirit led him to create an automotive YouTube channel…

Read MoreAre You Relying on Year-End Purchases for Tax Savings? Let’s Build a Smarter Plan

As the year comes to a close, many business owners feel pressured to make last-minute purchases—such as trucks or machinery—to take advantage of tax deductions. However, if you’re buying equipment you don’t truly need just to lower your tax bill, it may be time to rethink your strategy. Short-Term vs. Long-Term Tax Savings Focusing solely…

Read MoreUnderstanding Recent Market Volatility

Staying Informed and Focused Amidst Market Fluctuations The equity markets have recently experienced significant drops. With these sudden changes, we want to keep you informed about what’s happening. Here are some insights to help you navigate this period of ongoing volatility, especially with a contentious election ahead. If you have any questions about the market,…

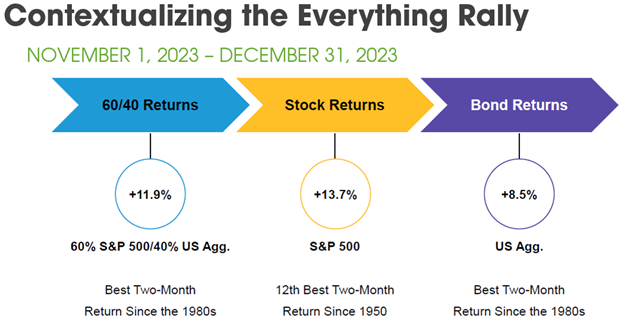

Read More2024 Q1 Market Update

We hope you enjoyed the holiday season with the ones that matter most. Everyone at Vance Wealth is excited for this New Year, and we are motivated to begin making progress on our personal and firm goals. While past performance is not indicative of future results, we like to reflect on the past year to…

Read MoreYour Year-End Tax Planning Checklist: Securing Your Financial Future

As the holiday season approaches, it is not just your gift list that deserves attention. Your year-end tax planning checklist is essential this year. Proactive financial experts understand that the months leading up to year-end provide a prime opportunity to make final tax-saving moves that can substantially impact your financial well-being. To help you prepare…

Read MoreTo Freeze or Not to Freeze: Safeguarding Your Financial Security. Simple steps to protect your credit!

To freeze or not to freeze… We’ve had a few questions recently around freezing credit, so we thought it best to share some great steps you can take to protect yourself! Essentially, freezing credit helps protect you from having identity thieves open credit accounts in your name. Once your credit is frozen, the credit reporting…

Read MoreHealth Tip

Professional success is often influenced by how we feel – physically, mentally and emotionally. That’s why a focus on health and wellness has naturally become a favorite part of our company culture. We love sharing new health tips and ideas whenever we find something that makes a difference in our energy levels and daily performance.…

Read MorePatti’s Perspective: Educating Young Adults on Money Smarts

Empowering Women to Achieve More Those who know me know that I am passionate about educating young adults with money smarts. Unfortunately, financial literacy isn’t taught in schools (although I see this increasing!), and often the conversations aren’t happening at home. College kids are graduating with credit card debt and student loan debt. A study…

Read More