Q3 2025 Market Update: Volatility, Recovery & AI Investment Trends Explained

Dear Clients and Friends,

We trust your summer is in full swing. Vacations have commenced, kids are in summer camp and young adult kids are back from college for the summer. Now is the time to make memories with your friends, family, kids or whoever matters most to you.

If you looked at the market level January 1st and checked in as of July 7th, the S&P 500 is +7.50%. You would think things seem to be quiet with a solid return YTD. This could not be further from the truth. The S&P 500 hit a record high in February, then dropped by nearly (-19%) by early April. In our view, this was caused by unexpected tariff announcements and the rollout schedule (or lack thereof) adding to global trade tensions. But just days later, after a delay in those tariffs were announced, markets bounced back just as sharply and have since recovered +26.20% from the April 8th bottom.

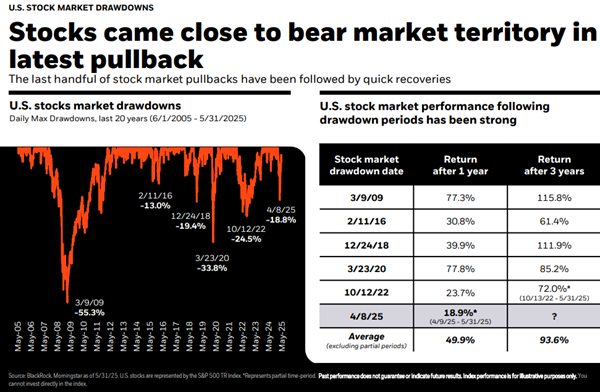

As investors, this was an unnerving time. We had countless conversations with clients during the period of elevated volatility. Our job was to remind them that volatility is normal; and while this does not feel good, we have a financial plan in place and disciplined investors are rewarded over the long-term. We cannot predict the market, and no one wants their advisors to try to do so. We are goal-focused, plan-driven, long-term investors. Everything we do is grounded in your personal financial plan. But because the last handful of stock market pullbacks have been followed by quick recoveries, we reminded clients not to panic. See the chart below1.

Past performance is not indicative of future results, but from the sample listed in the chart above, the average return over the next 1-year was +49.9% and +93.6% return after 3 years. If you sell during any one of these market pullbacks, your investments and financial security will be forever impacted with little ability to recover from those returns you missed out on.

While in Q1, S&P 500 earnings growth came in at 13.5% (vs. 6.5% expected)2, it is projected that real GDP (Gross Domestic Product) will slow this year. This does not mean there cannot be money made in the markets, but, a good reminder to temper expectations.

The U.S. economy has continued to remain resilient through the last several years of economic uncertainty. So much so, investors finally got to a point in the past year asking the question, “Why don’t we just own US Stocks. They have outperformed international markets since the Great Recession” The reason? Years like this year… With the S&P 500 up 7.50% through July 7th, International markets (MSCI EAFE) are +19.94%. This diversification significantly helped portfolios “hold up” much better during the periods of volatility. But, we are finally seeing our disciplined allocation to international companies adding to performance vs. being a detractor.

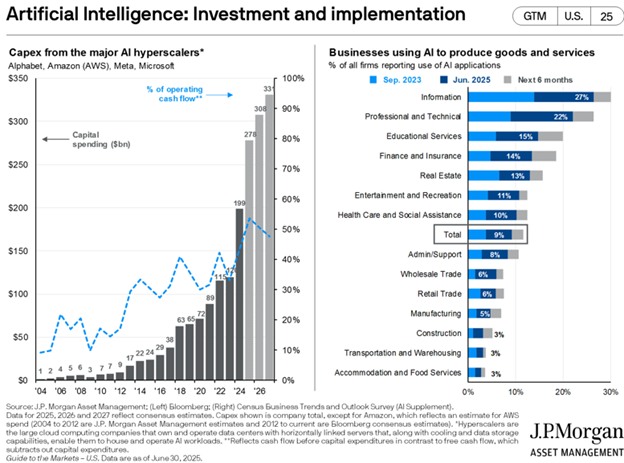

At Vance Wealth, we are optimist by default 😊. There is still so much to be excited about with all of the bright minds out there running companies. Clearly, AI (Artificial Intelligence) is becoming commonplace in our every day lives (so much so you may not even know it is AI at times). But, the massive spend as outlined in the chart below3 is proving companies are not only investing in it, they are massively committing to this and are projected to level-up in the coming years.

On the left, its show investment spending by four major AI hyperscalers in the U.S., which has increased in recent years and is expected to continue rising in the years ahead. Alphabet/Amazon/Meta/Microsoft spent approximately $200 billion on AI in 2024 which is just under 60% of their total operating cash flows. In 2027, it’s projected to increase to $331 billion and about 95% of operating cash flows. This is “funny money” levels and hard to comprehend. On the right, the chart shows the latest trends in AI business adoption in the U.S. Adoption is still in its early stages, but it indicates that many sectors, not just information technology, are leveraging or plan to leverage this powerful technology. While AI adoption is still in its early stages, continued adoption across industries could cause U.S. productivity growth to trend higher.

For our clients, we are continuing to monitor the accounts for any possible adjustments. If volatility picks back up, there will be opportunities to deploy fresh cash, rebalance accounts, tax loss harvest, Roth IRA conversions etc.

If you are not currently a Vance Wealth client and would like to discuss your long-term financial plan & investments in greater detail, please get in touch with our office to schedule time with one of our Wealth Advisors. Now is a better time than ever to look at your current investments and financial plan to make sure they are properly positioned for the unexpected.

Regards,

Jerrod Ferguson, CFP®

Partner, Vance Wealth

Disclosures: The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Past performance does not guarantee future results. The information provided is for educational and illustrative purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Vance Wealth, LLC. (“Vance Wealth”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Vance Wealth and its representatives are properly licensed or exempt from licensure. The S&P 500 is an unmanaged index of 500 widely held stocks. Investors cannot invest directly in an index.

Sources:

- BlackRock – Student of the Market, June 2025. “Stocks came close to bear market territory in latest pullback”

- BlackRock – Student of the Market, June 2025. “Slowing, but not stalling, U.S. Growth”

- JP Morgan – Guide to the markets, July 2025