BLOG

Honoring the Women of Impact at Vance Wealth

As the founder of Vance Wealth, I am deeply inspired every day by the commitment and leadership of our team. However, in honor of International Women’s Day, I have decided to specifically highlight the exceptional women on our team. Their profound impact on our growth and culture transcends mere recognition; it sets the standard for…

Legacy Series: Avoiding Common Mistakes When Transferring Wealth

An interview with Vance Wealth Vice President, Jerrod Ferguson Q: What are some common mistakes high-net-worth families make when transferring wealth to the next generation? Passing on a legacy isn’t easy, and there are three common mistakes we often see—mistakes that can be avoided with the right guidance and planning. 1. Not Having a Plan…

Have You Subscribed to Our YouTube Channel Yet?

Don’t miss out on exclusive educational content, market updates, and live-streamed insights designed to help you stay informed and ahead. Why Subscribe? Instant Updates: Get notified about live streams and new videos as soon as they’re available. Convenience: Access valuable content anytime, anywhere. How to Subscribe: Go to the Vance Wealth YouTube channel. Click the…

We Are Hiring!

Join Our Team: Investment Associate Role at Vance Wealth At Vance Wealth, we’re not just a financial planning firm—we’re a team driven by purpose, collaboration, and a commitment to delivering exceptional client experiences. We’re seeking an Investment Associate to support investment and trading operations. In this role, you’ll ensure the smooth execution of trades, manage…

From the Desk of John Vance

To Our Vance Wealth Friends and Family, As we wrap up 2024 and look toward the New Year, I’m filled with both gratitude and excitement for what lies ahead. This season has been filled with moments worth celebrating—both personally and professionally. The highlight of this past quarter was, without a doubt, our wedding celebration in…

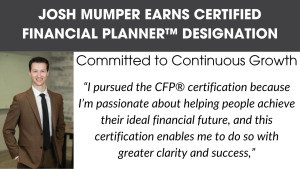

Josh Mumper Earns CERTIFIED FINANCIAL PLANNER™ Designation

Committed to Continuous Growth At Vance Wealth, we take pride in celebrating the accomplishments of our team, and today we’re excited to recognize Josh Mumper for earning the CERTIFIED FINANCIAL PLANNER™ (CFP®) certification, demonstrating his passion for delivering the highest level of financial planning expertise. This accomplishment marks a significant milestone in Josh’s professional growth…

Planning For Longevity: The Two Essentials for A Fulfilling Future

There are two vital pieces to ensuring a long, happy future: a strong financial plan and a commitment to health. At Vance Wealth, we’ve seen firsthand how these two elements work together through the example of our clients, who demonstrate how to live well, age well and truly enjoy every stage of life. “Some of…

Press Release -simplify365®

FOR IMMEDIATE RELEASE simplify365®: Get Organized. Build Wealth. Achieve More. Santa Clarita, CA — February 3rd, 2025 — Business owners now have a specialized solution to simplify their financial management and maximize their savings with the launch of simplify365®, a division of Vance Wealth. Running a business is as rewarding as it is demanding. When…

Navigating Market Uncertainty with Confidence

Do you ever feel like the unpredictability of today’s world is unprecedented? Many investors, especially those with progressive values or concerns about today’s political climate, may feel like we’re in uncharted territory. The headlines, the policies, the uncertainty, it can all feel overwhelming. It’s natural to think, this time feels different. But history tells a…