Business Owner

Avoid Late Fees and Streamline Your 5500 Filing with Advanced 401k Solutions

The Form 5500 filing process is a critical requirement for employee benefit plans. However, it can be complex, time-consuming, and pose significant administrative challenges for plan administrators. With the July 31st deadline fast approaching, avoiding late fees, and streamlining the process is crucial. In this blog post, we’ll discuss how partnering with Advanced 401k Solutions…

Read MoreThe Value of Having Your Kids Work in the Family Business: Building Character, Practical Skills & Generational Wealth

Imparting Values and Creating Generational Wealth through Family Business Running a family business can be challenging, but involving your children in the operation can provide many benefits beyond just practical skills. Children who work alongside their parents and other family members gain practical experience that they can carry with them throughout their lives. In addition…

Read MoreVance Wealth Expands Presence with New Office in Newport Beach

Premier Santa Clarita-based financial planning firm extends reach to serve Newport Beach community Newport Beach, Calif. — Vance Wealth, a leading provider of comprehensive financial planning solutions headquartered in Santa Clarita, proudly announces the opening of its newest office in Newport Beach, California. This strategic expansion represents a significant milestone for the company, fortifying its…

Read MoreTracking Your Health as a Busy Business Owner: Key Numbers to Monitor for Better Well-Being

As a busy business owner, taking care of your health may not always be at the top of your to-do list. However, tracking certain numbers allows you to stay on top of your health and make informed decisions to enhance your overall well-being. Blood pressure – High blood pressure can lead to serious health problems,…

Read MoreUnlock More Potential: Entrepreneur Edition

A Valuable Solution for Business Owners to Stay on Course Throughout the Year If you run a business, then you know how rewarding it can be – and you also know how consuming it can be, too. It’s hard not to get caught up in the day-to-day grind, but what affects your business affects your…

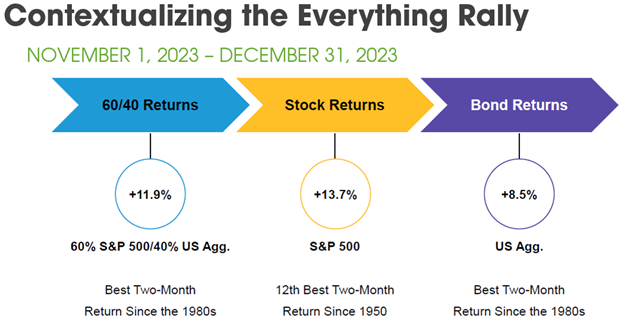

Read More2024 Q1 Market Update

We hope you enjoyed the holiday season with the ones that matter most. Everyone at Vance Wealth is excited for this New Year, and we are motivated to begin making progress on our personal and firm goals. While past performance is not indicative of future results, we like to reflect on the past year to…

Read MoreUnlock More Potential: Entrepreneur Edition

A Valuable Solution for Business Owners to Stay on Course Throughout the Year If you run a business, then you know how rewarding it can be – and you also know how consuming it can be, too. It’s hard not to get caught up in the day-to-day grind, but what affects your business affects your…

Read MoreSetting Goals That Stick In Life & Business

As a business owner, your success is only as strong as the foundation it’s built on: you. If you’re not operating at your best, you can’t give your best to your business. That’s why it’s important to start your business planning with a big-picture view of your life and personal finances. By aligning your business…

Read MoreAvoid These Common Tax Mistakes

The most costly and common tax mistakes are not errors but missed opportunities to achieve more. Here’s how to avoid them. More often than not, the most costly tax mistakes we see are not errors but missed opportunities. Including overlooked opportunities for long-term planning, strategic deductions, and reduction of your lifetime tax liability. The easiest way to…

Read MoreCapitalizing on Family Support: Optimize Your Payroll for Tax Advantages and Increase Your Retirement Savings

We understand that owning and running a business often becomes a family affair. Spouses and children play vital roles in various aspects, from casual conversations at the dinner table to continuous discussions about the business’s health. This is one of the many reasons we recommend optimizing your payroll to include these hardworking family members. We…

Read More