Understanding Recent Market Volatility

Staying Informed and Focused Amidst Market Fluctuations

The equity markets have recently experienced significant drops. With these sudden changes, we want to keep you informed about what’s happening. Here are some insights to help you navigate this period of ongoing volatility, especially with a contentious election ahead. If you have any questions about the market, your accounts, or your long-term financial plan, please reach out to our team. We’re here to help!

What’s Going On?

Last week, the Fed decided to keep their target interest rate elevated at 5.25%. Then, Friday rolled around with an unemployment report that showed an increase to 4.3%. Going back almost 80 years, the long-term average unemployment rate is about 5.70%. We’ve been in a labor market with more job openings than those looking for work. The economy isn’t broken, but it’s getting tighter, and we’re keeping an eye on it. (we speak more to this in John’s most recent Mid-Year Economic update that you can watch here – OR – In our most recent newsletter Market Update which you can read here.

The volatility index has hit levels we haven’t seen since COVID-19 and the Financial Crisis. However, this doesn’t mean a crash is imminent. The bigger risk is waiting on the sidelines for a crash that doesn’t happen while the market continues to rise. Diversification reigns supreme in times of volatility, which is why a portfolio should comprise both bonds and stocks. (Bonds are up 3% over the past five days.)

Warren Buffet is in the headlines for moving a portion of his Apple position to cash, now sitting on his largest cash pile in history. While these facts are true, it’s important to add perspective. Yes, he sold nearly half of his Apple position, but Apple remains his number one holding. Buffet is still heavily invested, with roughly 85% in investments and only 15% in cash.

International Influences and The Carry Trade

Japan’s recent move to raise interest rates has impacted global markets. Historically, Japan kept rates low, and institutional investors borrowed at these lower rates to invest domestically. As Japan raises rates, these institutions are deleveraging their borrowed positions by selling equities. This phenomenon, known as “The Carry Trade,” has contributed to recent volatility across all markets, not just in Japan. – Watch a two-minute video explaining – The Carry Trade here.

The Magnificent 7 and Market Corrections

The “Magnificent 7” stocks have led the charge in volatility, both on the upside this year and the downside. Last week, on a day when the market was down over 1.00%, over 1/3 of stocks in the S&P 500 were positive. The massive swings in volatility at the index level are due to the Mag 7’s significant weight. This is why diversification is crucial, and why we’re not overly exposed to the Mag 7. While we may miss some upside, we believe our downside risk will be mitigated when market volatility occurs.

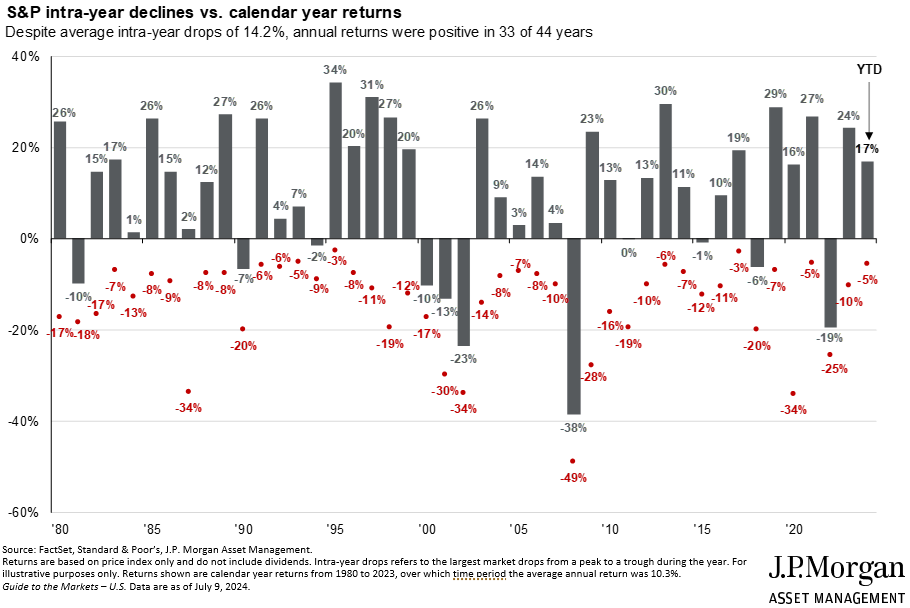

Did you know market corrections (down 10% or more) happen nearly 65% of all years? The fact that we haven’t had a correction yet this year is actually more abnormal. Let’s say we have a correction of 10%, the market would still be positive this year. And since the October of 2022 lows, even with a correction this year, we’d still be 45% higher than where we were. It’s all about perspective.

- The chart below illustrates S&P 500 intra-year declines vs. calendar year returns. On average, going back to 1980, the market has intra-year drops of 14.2%, but annual returns were positive 75% of the time. If you look most recently to the market peak of the S&P 500 of 5,667 set on July 16th, the market was down approximately (-10%). This means, the recent market volatility while sudden, is not out of the ordinary. And historically speaking, still “light” compared to a normal year. This could mean more short-term weakness is not out of the question.

For some historical context above, in 1998, the Russian Bond Market defaulted. From peak to trough, the market was negative (-19%), but ended the year +27%. We are not predicting this is going to happen, but, the recent volatility is normal and does not necessarily signal a market crash.

The time to move out of cash is now (and has been for a few months). With money market yields expected to drop, moving into bonds is prudent if you have money beyond a fully funded emergency fund. These are conversations we are having as an Investment Team and will discuss proactively with relevant clients.

Managing Emotions and Focusing on Long-Term Goals

Investing is an emotional experience. While we advisors take a logical approach to decision-making, it’s hard not to get swept up in the media noise. This is why we focus on our clients’ financial plans, both short and long-term goals, and future cash flow needs. This allows us to plan for the “unexpected,” because it’s not a matter of IF, but WHEN.

Markets are efficient over time. There’s so much to be excited about in terms of innovation and growth opportunities. The fear and scarcity mentality can be debilitating in life and investing. At Vance Wealth, we pride ourselves on an abundance mindset, and we will double down on this as the remainder of the election year unfolds. Focus on what you can control; spend time with loved ones and do what you love (hopefully not watching the news 😊). We will continue to monitor the markets and your accounts and take any necessary action.

We are here for you if you have additional questions, but hopefully, this update provides some peace of mind that this is not out of the ordinary. If you are not a Vance Wealth client and would like to discuss your personal financial situation, we offer complimentary consultations, you can book here.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.