Posts Tagged ‘tax planning’

Josh Mumper Earns CERTIFIED FINANCIAL PLANNER™ Designation

Committed to Continuous Growth At Vance Wealth, we take pride in celebrating the accomplishments of our team, and today we’re excited to recognize Josh Mumper for earning the CERTIFIED FINANCIAL PLANNER™ (CFP®) certification, demonstrating his passion for delivering the highest level of financial planning expertise. This accomplishment marks a significant milestone in Josh’s professional growth…

Read MorePress Release -simplify365®

FOR IMMEDIATE RELEASE simplify365®: Get Organized. Build Wealth. Achieve More. Santa Clarita, CA — February 3rd, 2025 — Business owners now have a specialized solution to simplify their financial management and maximize their savings with the launch of simplify365®, a division of Vance Wealth. Running a business is as rewarding as it is demanding. When…

Read MoreUnderstanding the Corporate Transparency Act

The Corporate Transparency Act is affecting many business owners, investors and real estate owners. Here’s how: On Jan. 1, 2024, a significant regulatory change went into effect that impacts limited liability companies (LLCs), corporations and other entities, but its reach extends beyond the typical business owner. The Corporate Transparency Act (CTA) requires certain businesses…

Read MoreUnlock More Potential: Entrepreneur Edition

A Valuable Solution for Business Owners to Stay on Course Throughout the Year If you run a business, then you know how rewarding it can be – and you also know how consuming it can be, too. It’s hard not to get caught up in the day-to-day grind, but what affects your business affects your…

Read More2024 Q1 Market Update

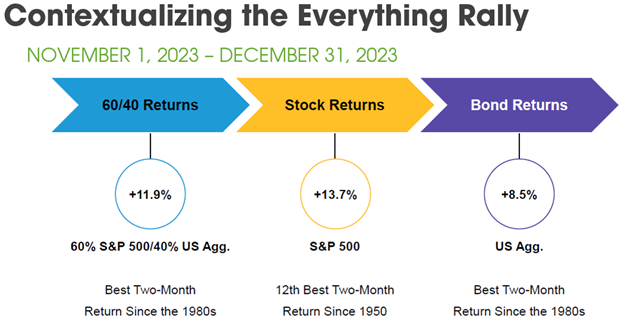

We hope you enjoyed the holiday season with the ones that matter most. Everyone at Vance Wealth is excited for this New Year, and we are motivated to begin making progress on our personal and firm goals. While past performance is not indicative of future results, we like to reflect on the past year to…

Read MoreUnlock More Potential: Entrepreneur Edition

A Valuable Solution for Business Owners to Stay on Course Throughout the Year If you run a business, then you know how rewarding it can be – and you also know how consuming it can be, too. It’s hard not to get caught up in the day-to-day grind, but what affects your business affects your…

Read MoreUnleashing the Augusta Rule: A Game-Changing Tax Strategy for Business Owners with Simplify365™

Introduction: Are you a business owner not yet taking advantage of the Augusta Rule? If you’re running an S Corporation or C Corporation, this tax-saving opportunity might be right under your nose. In this blog, we’ll explore the Augusta Rule, its benefits, potential risks, and how Simplify365™ can guide you through a seamless implementation process.…

Read MoreYour Year-End Tax Planning Checklist: Securing Your Financial Future

As the holiday season approaches, it is not just your gift list that deserves attention. Your year-end tax planning checklist is essential this year. Proactive financial experts understand that the months leading up to year-end provide a prime opportunity to make final tax-saving moves that can substantially impact your financial well-being. To help you prepare…

Read MoreAvoid These Common Tax Mistakes

The most costly and common tax mistakes are not errors but missed opportunities to achieve more. Here’s how to avoid them. More often than not, the most costly tax mistakes we see are not errors but missed opportunities. Including overlooked opportunities for long-term planning, strategic deductions, and reduction of your lifetime tax liability. The easiest way to…

Read MoreThe High Cost of Tax Mistakes: Vance Wealth’s Solution for Business Owners

The High Cost of Tax Mistakes: Vance Wealth’s Solution for Business Owners As a business owner, you’re juggling countless responsibilities and striving to grow your enterprise. At Vance Wealth, we understand the challenges you face, and we’re here to ensure that you’re not only growing your business but also taking advantage of every legal tax-saving…

Read More