2023 – Q3 Market Update

Dear Clients and Friends,

We are already more than halfway through 2023; time once again seems to elude us. We hope your summer months have been busy with the things you enjoy most in life. Markets have bounced back strong to start the year which is welcomed from investors coming off a volatile and brutal 2022.

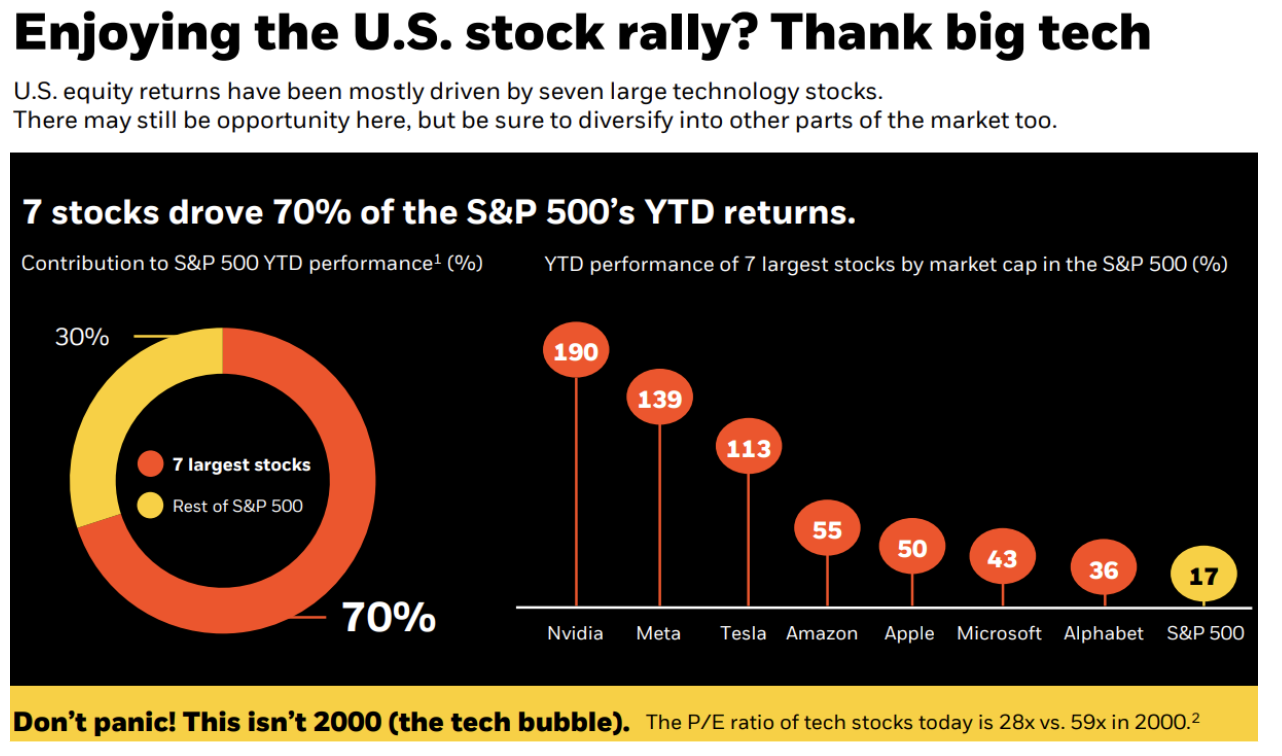

The broad markets are up; the S&P 500 through July 28th is +19.82%, the Dow Jones is +7.01% and the Naqdaq is leading the way +37.83%1. To drill into those figures even more, you will see from the chart below that 70% of the S&P 500’s YTD have been driven by 7 stocks2.

This means that if you have direct exposure here, you have greatly benefited from the outperformance. Don’t forget, large growth was the hardest hit sector of the market in 2022. It is no surprise that this is the best performing sector YTD. Here is a reminder of 2022 performance to remind you of the large swings that are possible with company specific risk:

- NVDA: (-50.26%)

- META: (-64.22%)

- TSLA: (-65.03%)

- AMZN: (-49.62%)

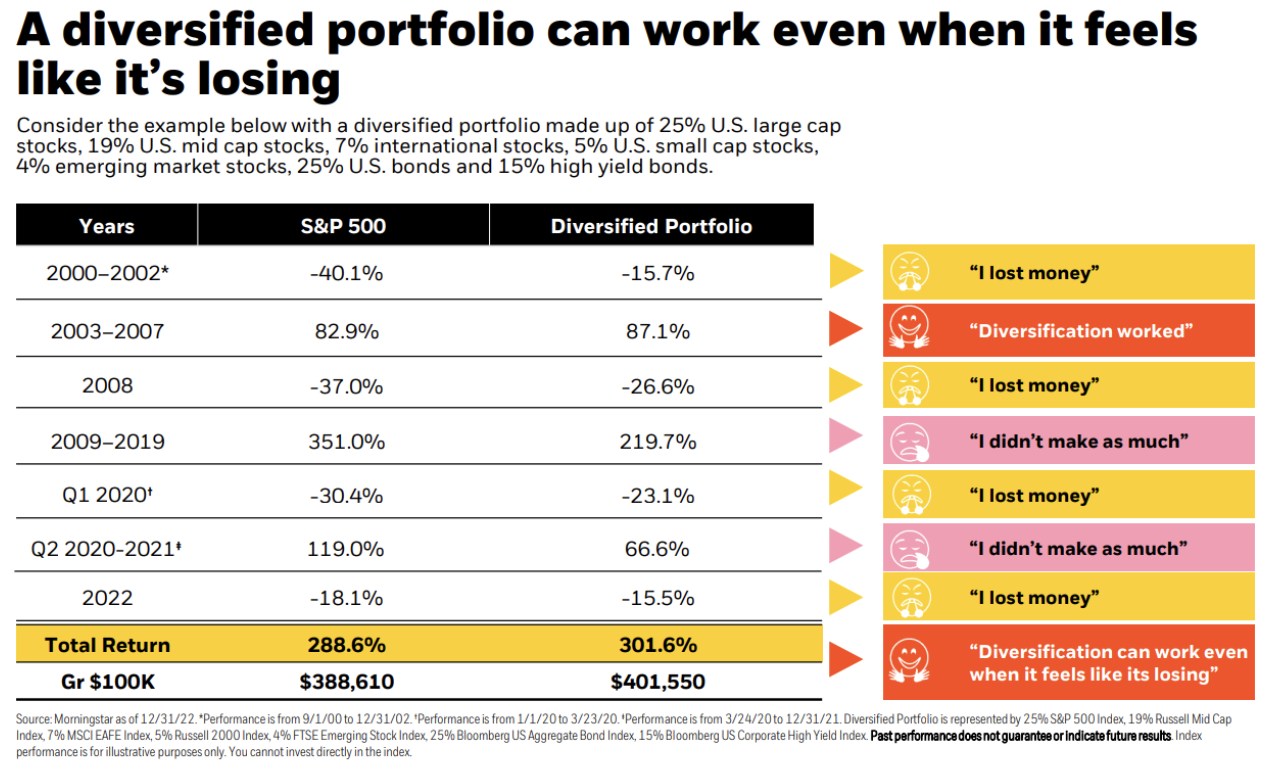

The majority of our clients are invested in well diversified, broad market investments that will provide exposure to thousands of companies at a low cost. This means that diversified portfolio’s have underperformed the companies listed above, but the broad markets as well. We understand during these periods, investors feel like “I didn’t make as much.” When there is a year like 2022 and the S&P 500 lost (-18.1%), investors say “I lost money” even if their diversified portfolio held up better, but still lost (-15.5%) on average. The chart below will show the diversification can work even when it feels like it’s losing:

Over the 22-year period, a diversified portfolio had a total return of 301% and the growth of $100,000 outperformed the S&P 500 over this time frame by almost $13,000. What this doesn’t factor in is the journey over this time period likely felt a lot smoother vs. the larger swings from year to year. The key to prudent investing within a diversified portfolio is rebalancing the accounts with purpose. Because of the extreme outperformance by the large growth sector, we have been actively trimming large growth positions in favor of adding to underperforming areas of the portfolio or rebuilding our clients fixed income allocation that was possibly spent down in 2022 when equity markets were negative.

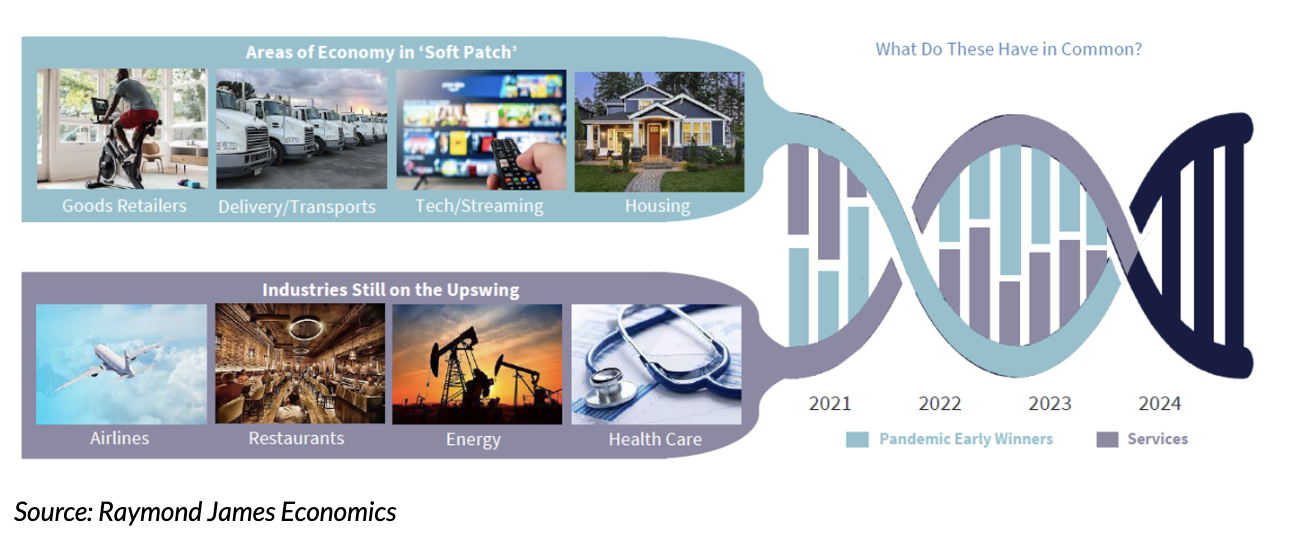

The tone for a recession has shifted dramatically from the start of the year based off easing inflation and a still-strong labor market. I think what we realized is that since COVID in 2020, there has been a non-synchronized decline of this business cycle. Certain industries have already exhibited weakness, while others have remained resilient. We expect this cycle to continue going forward, which should buffer any significant economic decline. Because of this, we believe diversification is key because it will be hard to predict which sectors will outperform and when.

At Vance Wealth, we are of the abundance mindset and know there is still so much to be excited about with our investment future. For example, the recent emergence of generative artificial intelligence (AI) raises the question of whether we are on the brink of a rapid acceleration in task automation that will significantly save time and labor costs, lead to a productivity burst, and increase the pace of economic growth. While AI technology will inevitably displace some workers, we anticipate that most displaced workers will eventually become reemployed in new occupations that emerge either directly from AI adoption or in response to the higher levels of labor demand generated by the productivity boost from non-displaced workers.

The reemployment of displaced workers due to the direct and indirect effects of technological change has plenty of historical precedent. Information technology, for example, displaced some workers in the early 2000s, but also directly led to the creation of new occupations like webpage designers, software developers, and digital marketing professionals, and indirectly increased labor demand in service industries such as healthcare, education, and food services4.

The positive employment effects of technological change are especially clear over longer time horizons. 60% of workers today are employed in occupations that did not exist in 1940, implying that over 85% of employment growth in the last 80 years can be explained by the technology-driven creation of new positions4. Because a lot of these new jobs do not yet exist, it is hard to even comprehend at this point what this means for the future of our economy and labor force. But this is the exciting part!

If you would like to discuss your long-term financial plan in greater detail or would value a review of your current investments, please contact our office to schedule time with one of our Wealth Advisors. If you are not currently a client and value a second opinion, we are here to help. Now is a better time than ever to look at your current investments and financial plan to make sure they are properly positioned for the unexpected.

Regards,

Jerrod Ferguson, CFP®

Vice President

Disclosures: The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Past performance does not guarantee future results. The information provided is for educational and illustrative purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Vance Wealth, Inc. (“Vance Wealth”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Vance Wealth and its representatives are properly licensed or exempt from licensure. The S&P 500 is an unmanaged index of 500 widely held stocks. Investors cannot invest directly in an index.

Sources:

-

Google Finance as of July 28, 2023

-

BlackRock Student of the Market – Q3 Outlook

-

Raymond James Economics

-

Goldman Sachs: Top of Mind – Generative AI: Hype, or Truly Transformative