Posts Tagged ‘planning’

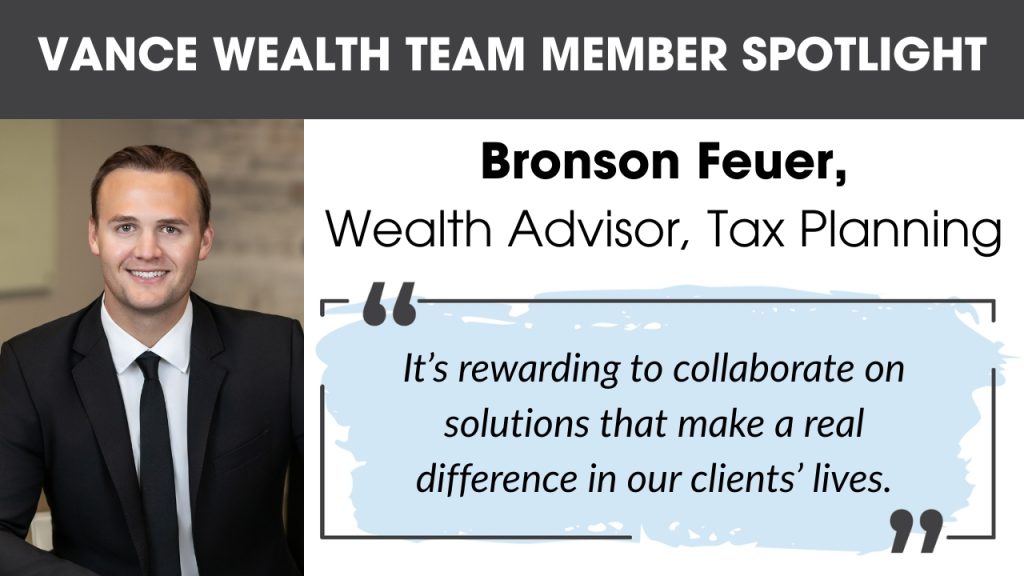

Vance Wealth Team Member Spotlight

Bronson Feuer, Wealth Advisor, Tax Planning With a seasoned background in tax compliance and a full-circle return to his hometown, Wealth Advisor Bronson Feuer delivers specialized expertise in Tax Planning, as well as a passion for guiding clients through complex strategies with clarity and confidence. Raised in Santa Clarita, Bronson graduated from West Ranch High…

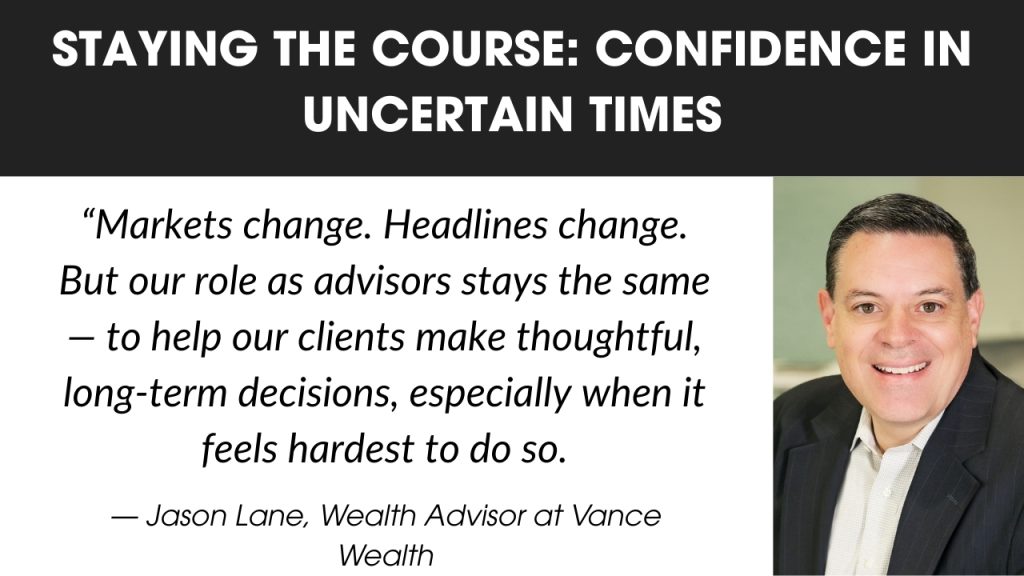

Read MoreStaying the Course: Confidence in Uncertain Times

At Vance Wealth, we understand how uneasy financial headlines can feel — because we’re investors, too. We’ve built our lives, our careers, and our futures on the same principles we recommend to you. And that’s exactly why we believe now is the time to lean into long-term perspective. We’re in a period where interest rates…

Read MoreIn the Community

Jerrod Ferguson Joins The SCV Chamber Board Of Directors At Vance Wealth, we believe in building a stronger community by stepping up, serving others and leading with purpose. That’s why we’re proud to share that our very own, Jerrod Ferguson has been appointed to the Board of Directors for the Santa Clarita Valley Chamber of…

Read MoreLegacy Series: Instilling Financial Responsibility in the Next Generation

A CONVERSATION WITH JERROD FERGUSON, OWNER & VICE PRESIDENT AT VANCE WEALTH How do we prepare the next generation to handle wealth with wisdom? It starts with small habits that lead to big lessons. One of my favorites is the Three Bucket Rule. Anytime my kids receive a dollar, we divide it like this: •…

Read MoreStrategic Tax Planning with Simplify365®

Keep More of What You Earn In a business climate where every decision impacts your bottom line, effective tax planning isn’t just a necessity, it’s a strategic advantage. That’s why we created simplify365®, a comprehensive tax planning program designed to help you manage your tax burden proactively and keep more of what you’ve built. A…

Read MoreFrom the Desk of John Vance – To Our Vance Wealth Friends and Family

So far, this year has been full of meaningful moments — and I’m feeling especially grateful for the balance of family time, professional growth, and the community that ties it all together. In late March, Carmen and I set off on a special trip overseas. We spent a few days in London, enjoying theater performances…

Read MoreLegacy Series: Avoiding Common Mistakes When Transferring Wealth

An interview with Vance Wealth Vice President, Jerrod Ferguson Q: What are some common mistakes high-net-worth families make when transferring wealth to the next generation? Passing on a legacy isn’t easy, and there are three common mistakes we often see—mistakes that can be avoided with the right guidance and planning. 1. Not Having a Plan…

Read MoreHave You Subscribed to Our YouTube Channel Yet?

Don’t miss out on exclusive educational content, market updates, and live-streamed insights designed to help you stay informed and ahead. Why Subscribe? Instant Updates: Get notified about live streams and new videos as soon as they’re available. Convenience: Access valuable content anytime, anywhere. How to Subscribe: Go to the Vance Wealth YouTube channel. Click the…

Read MoreWe Are Hiring!

Join Our Team: Investment Associate Role at Vance Wealth At Vance Wealth, we’re not just a financial planning firm—we’re a team driven by purpose, collaboration, and a commitment to delivering exceptional client experiences. We’re seeking an Investment Associate to support investment and trading operations. In this role, you’ll ensure the smooth execution of trades, manage…

Read MoreFrom the Desk of John Vance

To Our Vance Wealth Friends and Family, As we wrap up 2024 and look toward the New Year, I’m filled with both gratitude and excitement for what lies ahead. This season has been filled with moments worth celebrating—both personally and professionally. The highlight of this past quarter was, without a doubt, our wedding celebration in…

Read More