Posts by Shanele Stoll

How To Prioritize Business Growth

With The simplify365® Team In the fast-paced world of entrepreneurship, finding time to streamline operations and focus on growth can be challenging. Some business owners are aware that they could be doing things more efficiently, but they just don’t have the time to put systems in place. Others are unaware that they’re leaving planning strategies…

Read MoreYear-End Bonuses

Are They A Smart Tax Strategy For Businesses Or Not? “Business owners often get close to the end of the year, realize they haven’t made their recommended tax payments, and discover they’re now subject to penalties and interest,” explained John Vance, Founder and CEO of Vance Wealth. “To avoid these penalties, they may decide to…

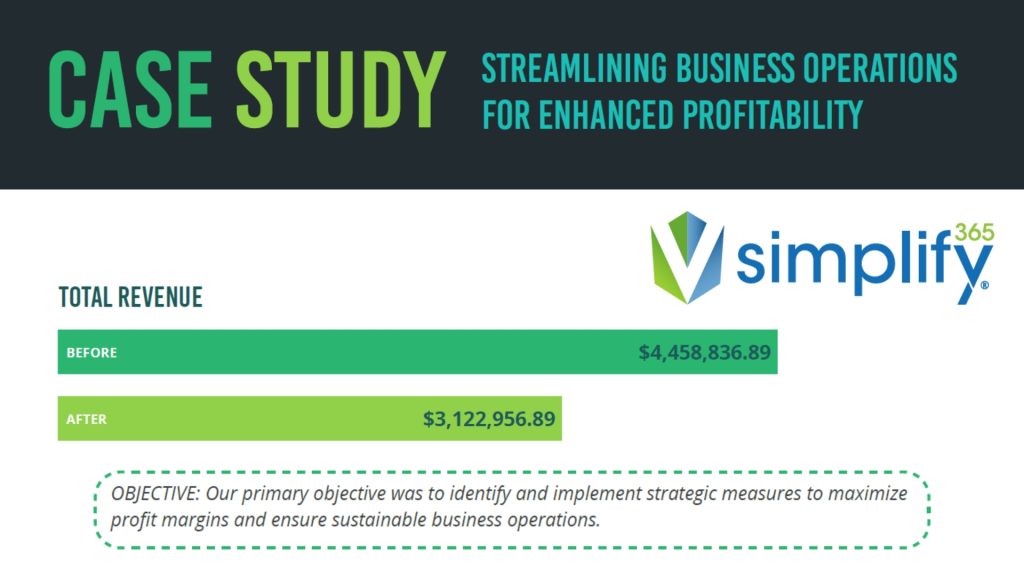

Read Moresimplify365® Streamlining Business Operations For Enhanced Profitability Case Study

simplify365® Financial Turnaround Case Study

simplify365® 401k Case Study

Avoid Late Fees and Streamline Your 5500 Filing with Advanced 401k Solutions

The Form 5500 filing process is a critical requirement for employee benefit plans. However, it can be complex, time-consuming, and pose significant administrative challenges for plan administrators. With the July 31st deadline fast approaching, avoiding late fees, and streamlining the process is crucial. In this blog post, we’ll discuss how partnering with Advanced 401k Solutions…

Read MoreThe Value of an Advisor: From Optimized Portfolios To Unemotional Decisions

One of the most significant ways we believe we add value to our clients’ lives is simply by helping them see what they may not see on their own. We might find opportunities for growth in their portfolio, establish their first comprehensive financial plan, or provide a vital sense of peace in those moments when…

Read MoreCelebrating Two Team Members Who Are Achieving More

Committed To Continuous Growth Celebrating Two Team Members Who Are Achieving More A commitment to continuous growth is one of the core values and driving forces behind the Vance Wealth team, and recently, two of our Wealth Advisors achieved goals that helped them grow their skills in a big way. Tyler Tilton completed his designation…

Read MoreVance Wealth Recognized as an Inc. 5000 Honoree: A Testament to Visionary Leadership and Growth

SANTA CLARITA, California — Vance Wealth, a distinguished wealth management firm headquartered in Santa Clarita with offices in Pasadena and a forthcoming expansion into Newport Beach, proudly announces its selection as an Inc. 5000 award honoree for 2023. This prestigious accolade underscores Vance Wealth’s enduring commitment to excellence, visionary leadership, and exceptional service. The Inc. 5000…

Read MoreVance Wealth Team Member Spotlight: Josh Mumper, Wealth Associate

With a background as a 401k plan auditor, Josh Mumper is passionate about guiding business owners to design the retirement plan that helps them achieve more. Born in Pennsylvania but raised in Santa Clarita from a young age, Josh attended Trinity Classical Academy before going on to Liberty University, where he completed his bachelor’s degree…

Read More